Corruption risks remain among the most pressing problems in the tax sector. This is evidenced by the results of a survey of large businesses presented at the National Agency on Corruption Prevention (NACP) during a public discussion on the problems of interaction between business and the tax service and expectations from the reform. The event was attended by representatives of business associations, civil society and state institutions.

According to the mentioned survey, conducted at the request of the NGO Technologies of Progress, corruption risks in the work of the State Tax Service of Ukraine (STS) and bias during audits are more critical problems for large companies than the tax burden.

According to another survey commissioned by NACP, the tax service is the least corrupt among the areas with which businesses interact: in 2024, only about 15.8% of entrepreneurs reported facing a corruption situation.

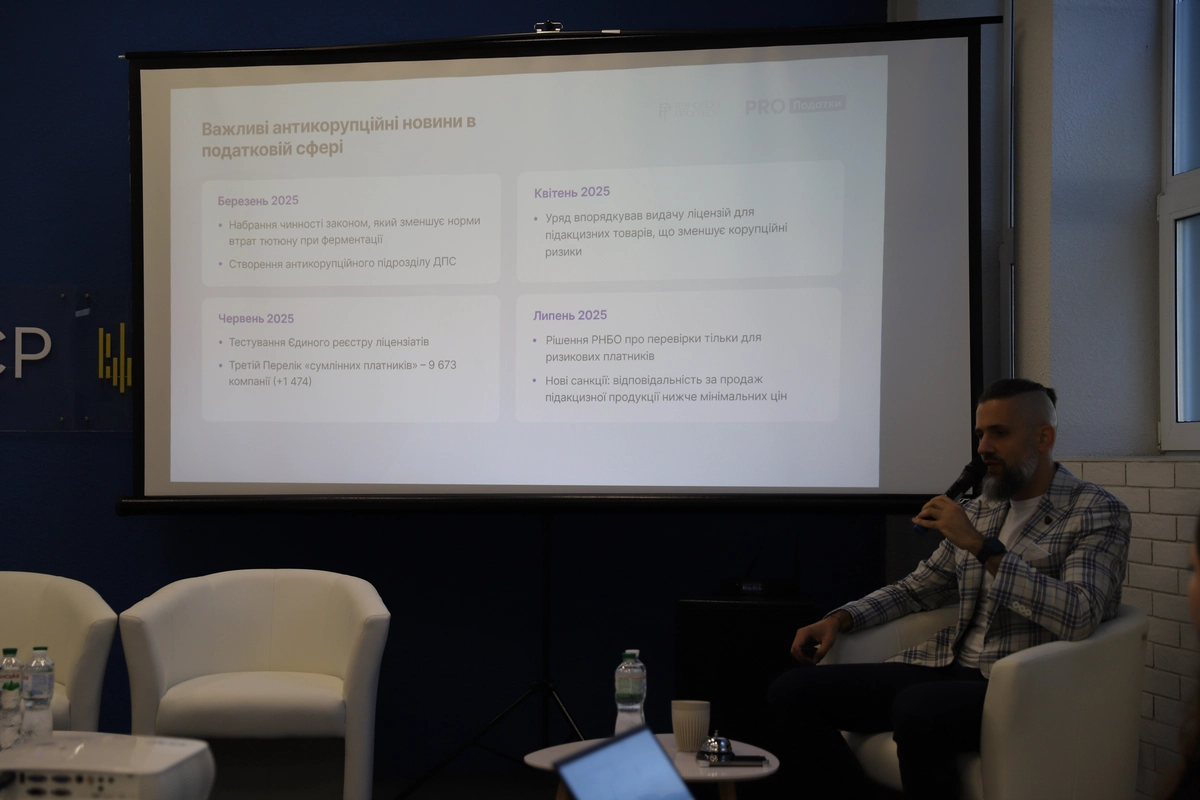

The comprehensive tax transformation currently underway aims to turn the fiscal system into a service platform focused on transparency, digitalization, and partnership with business. Within the framework of the reform, envisaged by the National Revenue Strategy, a number of innovations and anti-corruption safeguards are being introduced.

As stated by NACP Deputy Head Serhii Hupiak, this year the State Tax Service established a single authorized anti-corruption unit. The main goal of this innovation is to directly subordinate all anti-corruption authorized representatives of the territorial bodies of the STS to the Head of the STS. This will contribute to the independence of the single authorized unit, strengthen integrity and build taxpayers’ trust in the tax authorities. The National Agency provides methodological and coordination support in implementing this pilot project.

The co-founder of the NGO Technologies of Progress, Maksym Nefiodov, presented the results of an analysis of the tax service’s work.

"There is progress in many areas. The number of conscientious taxpayers is growing, and sales through cash registers are increasing. We also welcome legislative changes that introduced new rules for obtaining licenses for excisable goods, which reduced corruption risks," commented Maksym Nefiodov.

This year, a moratorium on business inspections by state authorities was also introduced, except for risky taxpayers, and electronic audit (“E-audit”) was implemented under the international SAF-T UA standard, which allows for tax audits to be conducted remotely without inspectors’ interference.

Member of Parliament, First Deputy Chairman of the Committee on Finance, Tax and Customs Policy, Yaroslav Zhelezniak, drew attention to the problem of the shadow economy.

"Business is not asking for tax benefits or additional preferences now. Businesses that work transparently are asking to address those who work in the shadows. There are high expectations here from the renewed Bureau of Economic Security and the tax service," said Yaroslav Zhelezniak.

Representatives of business associations who took part in the discussions at NACP emphasized the need to improve tax legislation and change the culture of interaction between the tax service and entrepreneurs.

"The Tax Code is saturated with fines for businesses, but holding a tax inspector accountable for an illegal decision is practically impossible," noted Vitalii Odzhykovskyi, Co-Chair of Legal Policy at the American Chamber of Commerce in Ukraine (ACC).

Most of the complaints from entrepreneurs (60%) received by the Business Ombudsman Council in 2024 and the first quarter of 2025 concerned tax issues. These included appeals related to tax audits, blocking of tax invoices, and inclusion in the lists of risky taxpayers. Serhii Hupiak reported that NACP will check how the recommendations previously provided to eliminate corruption risks in the procedure of suspension/resumption of tax invoice registration have been implemented within the framework of the relevant study.

Head of the Legal Department at YouControl, Nadiia Chalenko, emphasized the importance of publishing open data managed by the STS.

"The tax service does not publish more than 25 datasets out of the 46 defined by the relevant Cabinet of Ministers resolution. The most important among them are financial statements, information on tax arrears, and the license register. At the beginning of the war, this was a forced step, but now the information is needed by lawyers, financiers, and accountants to verify counterparties. These data are necessary for civil society to conduct research and investigations. Such a situation leads to a loss of trust and does not encourage businesses to work honestly," said Nadiia Chalenko.

According to Serhii Hupiak, NACP is preparing a study of key corruption risks in the tax sector. This topic will be the focus of a separate section of Ukraine’s new Anti-Corruption Strategy for 2026–2030, which the National Agency is developing together with expert teams. Specific measures will be included in the State Anti-Corruption Program.

The event was held with the support of the EU Anti-Corruption Initiative (EUACI).